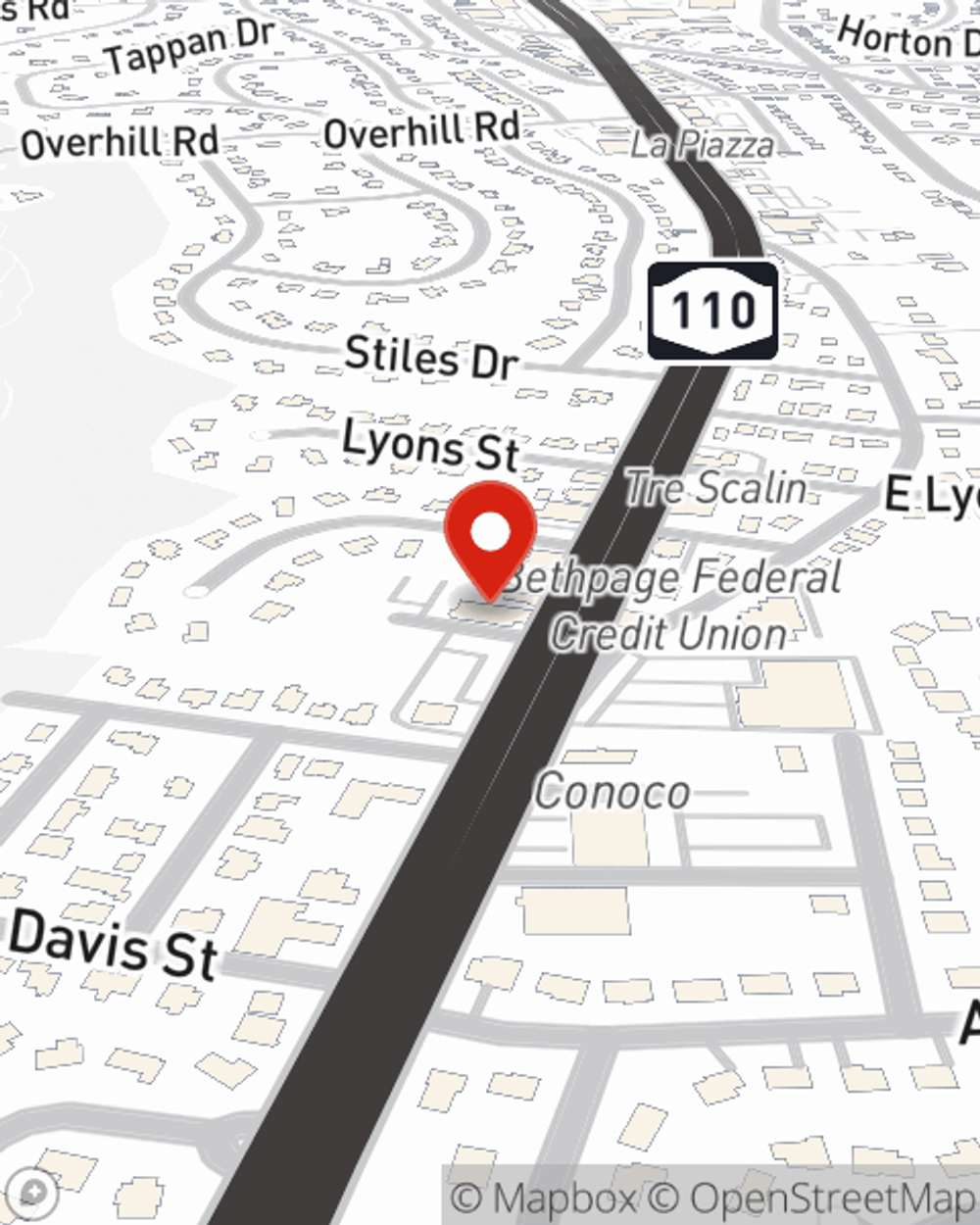

Homeowners Insurance in and around Melville

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

Committing to homeownership is a big responsibility. You need to consider your future needs needed repairs and more. But once you find the perfect place to call home, you also need excellent insurance. Finding the right coverage can help your Melville home be a sweet place to be.

A good neighbor helps you insure your home with State Farm.

The key to great homeowners insurance.

State Farm Can Cover Your Home, Too

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your most personal possessions safe. You’ll get a policy that’s adjusted to align with your specific needs. Fortunately you won’t have to figure that out on your own. With empathy and outstanding customer service, Agent Brian Gill can walk you through every step to build a policy that guards your home and everything you’ve invested in.

Having remarkable homeowners insurance can be invaluable to have for when the unexpected happens. Contact agent Brian Gill's office today to get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Brian at (631) 549-9444 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Flood insurance: What to know

Flood insurance: What to know

Learn the essentials of flood insurance and why it’s important for protecting against one of the costliest natural disasters in the United States.